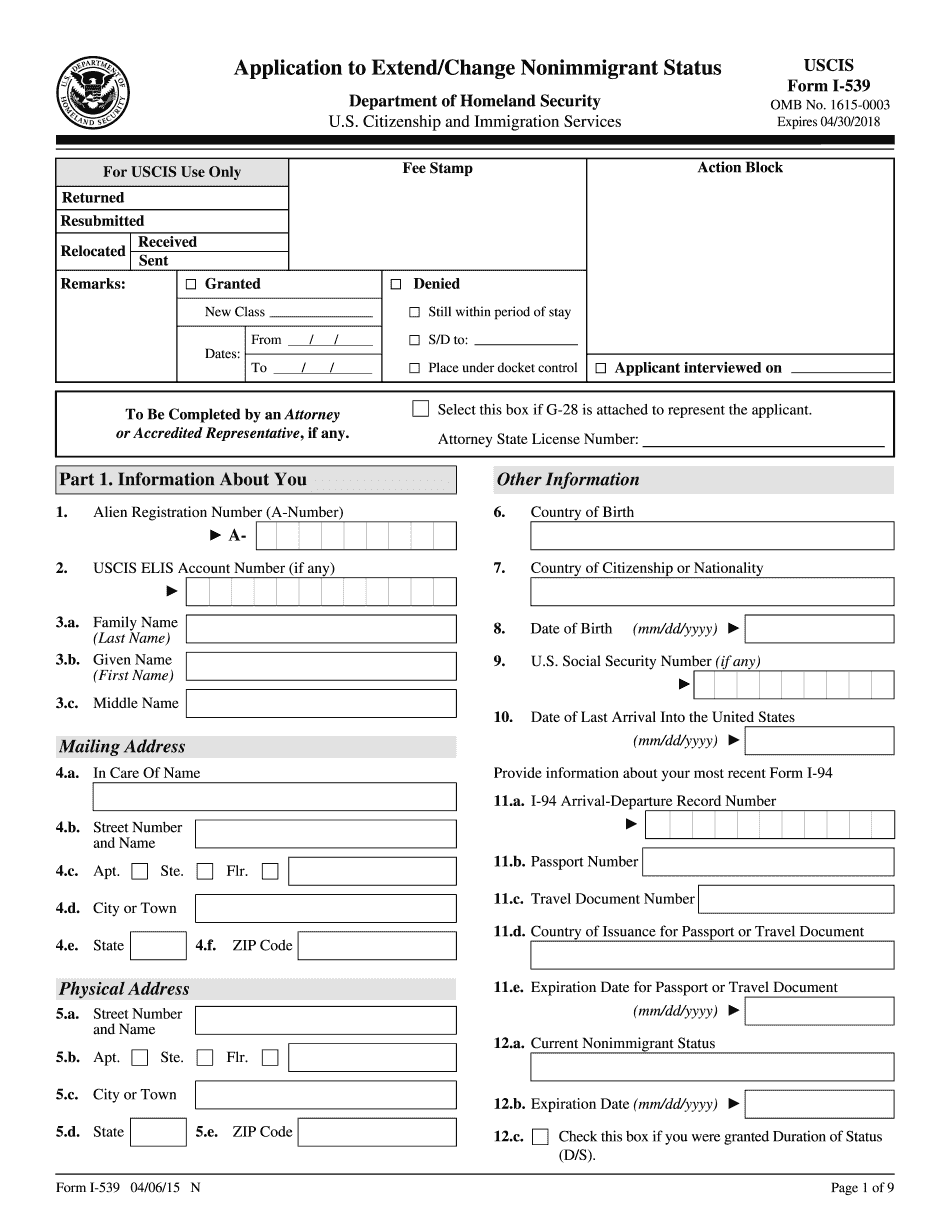

Welcome to this free immigration help channel in this video I will show you step-by-step instructions on how to fill out and file the form i-539 which is the application to extend or change non-immigrant status basically if you want to extend your non-immigrant Visa or if you want to change it from one non-immigrant to another non-immigrant status that's the video for you so as always as you can see I have the official U.S citizenship and immigration services website open in front of me uscis.gov this is the official source and I use it in all the videos that I make on this channel I don't use the third party website I don't use attorney websites I don't use the forums justusas.gov sometimes the Department of State website but always the official government sources now I am not an immigration attorney myself this is not a legal advice so with that being said let's get into it as so we're gonna navigate to the form itself we're going to click on forms right here at the very top of the navigation menu and then we're going to click on the very first one all forms that will give you all of the forms that are available from USCIS and we're going to scroll down they're in a numerical order alphabetical and numerical order five three nine there we go application to extend extend change non-immigrant status now the very first thing you notice and I'm gonna mention it right away is that there is an option to file this form online now in this video I will be showing you obviously the paper application which is going to be exactly the same as the online application is going to be the same information but I highly recommend you...

PDF editing your way

Complete or edit your forget to sign in i 539 form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export i 539 form instructions google search directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your eta 539 instructions as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your how do i sign form i 539 online by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form I-539

About Form I-539

Form I-539, officially known as the Application to Extend/Change Nonimmigrant Status, is a document used by individuals currently in the United States on a nonimmigrant visa who wish to extend their stay or change to a different nonimmigrant status. This form is typically required for individuals in various nonimmigrant visa categories, including but not limited to: 1. Dependents of nonimmigrant visa holders, such as spouses and children who are in the United States on a visa category that does not allow employment, like H-4 or L-2 visas. 2. Students who are currently studying in the United States and want to extend their stay to complete their program or pursue further studies, such as F-1 visa holders. 3. Individuals who are currently in the United States on a nonimmigrant visa and wish to request a change in their visa status, for example, from tourist (B-2) to student (F-1) visa. 4. Employees of international organizations or diplomatic missions who are in the United States on A or G visas and seek an extension of stay. 5. Other nonimmigrants who are eligible to apply for a change or extension of their nonimmigrant status based on the specific visa category and circumstances. In summary, Form I-539 is necessary for nonimmigrants in the United States seeking to extend their stay, change their nonimmigrant status, or fulfill other requirements as specified by the U.S. Citizenship and Immigration Services (USCIS). It is essential to consult the USCIS website or seek professional advice to determine if Form I-539 is the correct application for an individual's specific situation.

What Is I-539 Form?

Sometimes people who come to the United States for a temporary visit would like to extend their stay. Of course, there is some paperwork to be covered and the main document that one must complete is Form I-539.

This is Application to Extend Change Nonimmigrant Status. The USCIS however doesn’t guarantee that everyone filing the request will get it approved. It depends on the reason for the extension. There are some categories of visitors who are eligible to fill out their I-539:

-

Any nonimmigrant who has lawfully crossed the U.S. border;

-

Individuals who haven’t done anything illegal during their visit in US

-

Certain visitors that want to change their non-immigration status

The success of the application also depends on when it is filed. The best time to submit it is 45 days before your entrance visa expires. If you decide to file your I-539 within three months of your visit in US will most likely get a denial.

How to fill it out?

The fillable document is available online on the official website of the United States Citizenship and Immigration Services. On our website you can also obtain a printable PDF sample, download it and complete.

Though I-539 is rather self-explanatory with detailed instructions attached, it takes some time to properly complete it. The document contains nine pages and seven parts:

-

Part 1 stands for personal information such as name, contact details, SSN, etc.

-

Part 1 is for specific category of filers. Choose which one you belong to

-

Part 3 is for time processing purposes. Here you must specify the date when you’d like to expand your stay in US

-

Part 4 accounts for additional information

The remaining parts are created for signature and for other filers including assistants, dependent if any or entrepreneurs.

One of the most important supporting documents that must accompany the request is the copy of departure record I-94.

Where and when to send the completed document?

Though there is no specific due date for the document you must still submit it well in advance before your current visa expires. If you fail, there might be visa problems that can finally result in application denial. If that’s the case, you will be asked to leave the US immediately.

You should carefully check all the information you’ve provided. Once you’re sure everything is correct, and all the signers have put their signatures you can mail the request to the filing address you can find on United States Citizenship and Immigration Services website.

You will also have to pay the fee of $370.

The process is straightforward so it won’t take you long to complete the request in the right way. You can also entrust us other tasks. Here you can easily find the right form, fill it out using powerful editing tools and get it signed just in a few minutes.

Online methods enable you to arrange your document management and boost the productiveness of your workflow. Comply with the quick help as a way to total Form I-539, stay clear of mistakes and furnish it in the well timed manner:

How to complete a Form I-539 online:

- On the website with the form, simply click Start out Now and go to the editor.

- Use the clues to complete the applicable fields.

- Include your individual knowledge and make contact with knowledge.

- Make guaranteed that you simply enter right facts and figures in best suited fields.

- Carefully check the content material of your variety likewise as grammar and spelling.

- Refer that will help part if you have any questions or address our Aid crew.

- Put an electronic signature in your Form I-539 using the guide of Indication Device.

- Once the form is done, press Finished.

- Distribute the ready form by means of email or fax, print it out or conserve in your product.

PDF editor enables you to definitely make modifications towards your Form I-539 from any net linked system, customize it as outlined by your preferences, sign it electronically and distribute in various means.

What people say about us

Take full advantage of a professional form-filler

Video instructions and help with filling out and completing Form I-539